Some Ideas on Pacific Prime You Need To Know

Table of ContentsHow Pacific Prime can Save You Time, Stress, and Money.An Unbiased View of Pacific PrimeMore About Pacific Prime8 Simple Techniques For Pacific PrimeThe Ultimate Guide To Pacific Prime

Your agent is an insurance policy expert with the expertise to assist you through the insurance policy procedure and aid you discover the very best insurance coverage defense for you and individuals and things you appreciate the majority of. This write-up is for informative and tip objectives just. If the plan insurance coverage descriptions in this short article problem with the language in the policy, the language in the policy applies.

Insurance policy holder's fatalities can likewise be backups, specifically when they are considered to be a wrongful fatality, as well as building damages and/or destruction. Because of the uncertainty of stated losses, they are identified as contingencies. The insured individual or life pays a premium in order to obtain the advantages assured by the insurer.

Your home insurance can help you cover the damages to your home and afford the expense of restoring or fixings. Often, you can additionally have protection for things or prized possessions in your house, which you can then purchase replacements for with the cash the insurer gives you. In case of a regrettable or wrongful fatality of a single earner, a household's economic loss can possibly be covered by particular insurance coverage plans.

Things about Pacific Prime

There are various insurance policy plans that include financial savings and/or investment systems in enhancement to routine insurance coverage. These can aid with structure savings and wide range for future generations via normal or repeating investments. Insurance policy can help your household keep their requirement of living in case you are not there in the future.

The most fundamental type for this type of insurance, life insurance coverage, is term insurance. Life insurance policy as a whole assists your household come to be safe and secure monetarily with a payout amount that is given up the event of your, or the plan owner's, death during a certain policy duration. Youngster Strategies This kind of insurance coverage is generally a savings tool that aids with creating funds when youngsters get to specific ages for seeking higher education and learning.

Home Insurance coverage This sort of insurance covers home problems in the cases of crashes, all-natural calamities, and problems, together with other similar occasions. group insurance plans. If you are wanting to look for payment for mishaps that have actually happened and you are battling to find out the appropriate course for you, get to out to us at Duffy & Duffy Law Practice

Pacific Prime Things To Know Before You Buy

At our law practice, we comprehend that you are undergoing a lot, and we comprehend that if you are pertaining to us that you have actually been via a whole lot. https://pxhere.com/en/photographer/4223924. As a result of that, we provide you a free consultation to go over your worries and see how we can best help you

Because of the COVID pandemic, court systems have actually been shut, which adversely affects automobile crash instances in a significant method. Again, we are below to aid you! We proudly serve the individuals of Suffolk Region and Nassau Region.

An insurance plan is a lawful agreement between the insurance provider (the insurance company) and the individual(s), business, or entity being insured (the insured). Reviewing your plan assists you verify that the policy fulfills your demands which you understand your and the insurance coverage company's obligations if a loss happens. Several insureds buy a plan without recognizing what is covered, the exemptions that take away coverage, and the conditions that need to be satisfied in order for coverage to apply when a loss happens.

It recognizes that is the insured, what threats or home are covered, the plan limits, and the policy duration (i.e. time the plan is in force). The Declarations Page of a life insurance coverage plan will include the name of the person insured and the face amount of the life insurance plan (e.g.

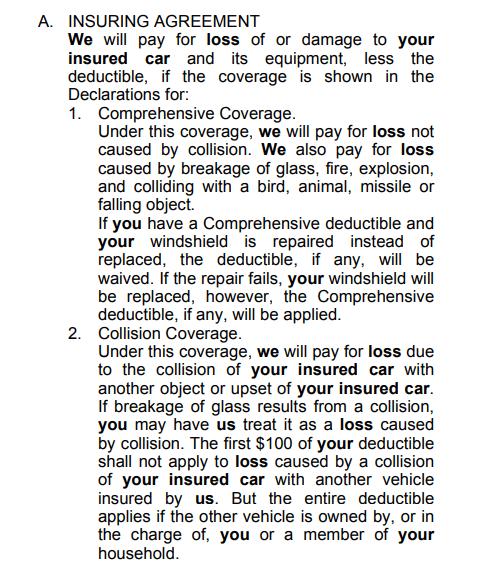

This is a recap of the significant assurances of the insurance business and specifies what is covered.

How Pacific Prime can Save You Time, Stress, and Money.

Life insurance coverage plans are usually all-risk policies. https://www.intensedebate.com/profiles/pacificpr1me. The three significant types of Exemptions are: Left out risks or reasons of lossExcluded lossesExcluded propertyTypical instances of excluded risks under a home owners plan are.